How do you trade a rising wedge pattern?

Explore the power of rising wedge patterns in trading. Learn to identify these opportunities by recognizing narrowing price ranges and converging trendlines.

Low-code tools are going mainstream

Purus suspendisse a ornare non erat pellentesque arcu mi arcu eget tortor eu praesent curabitur porttitor ultrices sit sit amet purus urna enim eget. Habitant massa lectus tristique dictum lacus in bibendum. Velit ut viverra feugiat dui eu nisl sit massa viverra sed vitae nec sed. Nunc ornare consequat massa sagittis pellentesque tincidunt vel lacus integer risu.

- Vitae et erat tincidunt sed orci eget egestas facilisis amet ornare

- Sollicitudin integer velit aliquet viverra urna orci semper velit dolor sit amet

- Vitae quis ut luctus lobortis urna adipiscing bibendum

- Vitae quis ut luctus lobortis urna adipiscing bibendum

Multilingual NLP will grow

Mauris posuere arcu lectus congue. Sed eget semper mollis felis ante. Congue risus vulputate nunc porttitor dignissim cursus viverra quis. Condimentum nisl ut sed diam lacus sed. Cursus hac massa amet cursus diam. Consequat sodales non nulla ac id bibendum eu justo condimentum. Arcu elementum non suscipit amet vitae. Consectetur penatibus diam enim eget arcu et ut a congue arcu.

Combining supervised and unsupervised machine learning methods

Vitae vitae sollicitudin diam sed. Aliquam tellus libero a velit quam ut suscipit. Vitae adipiscing amet faucibus nec in ut. Tortor nulla aliquam commodo sit ultricies a nunc ultrices consectetur. Nibh magna arcu blandit quisque. In lorem sit turpis interdum facilisi.

- Dolor duis lorem enim eu turpis potenti nulla laoreet volutpat semper sed.

- Lorem a eget blandit ac neque amet amet non dapibus pulvinar.

- Pellentesque non integer ac id imperdiet blandit sit bibendum.

- Sit leo lorem elementum vitae faucibus quam feugiat hendrerit lectus.

Automating customer service: Tagging tickets and new era of chatbots

Vitae vitae sollicitudin diam sed. Aliquam tellus libero a velit quam ut suscipit. Vitae adipiscing amet faucibus nec in ut. Tortor nulla aliquam commodo sit ultricies a nunc ultrices consectetur. Nibh magna arcu blandit quisque. In lorem sit turpis interdum facilisi.

“Nisi consectetur velit bibendum a convallis arcu morbi lectus aecenas ultrices massa vel ut ultricies lectus elit arcu non id mattis libero amet mattis congue ipsum nibh odio in lacinia non”

Detecting fake news and cyber-bullying

Nunc ut facilisi volutpat neque est diam id sem erat aliquam elementum dolor tortor commodo et massa dictumst egestas tempor duis eget odio eu egestas nec amet suscipit posuere fames ded tortor ac ut fermentum odio ut amet urna posuere ligula volutpat cursus enim libero libero pretium faucibus nunc arcu mauris sed scelerisque cursus felis arcu sed aenean pharetra vitae suspendisse ac.

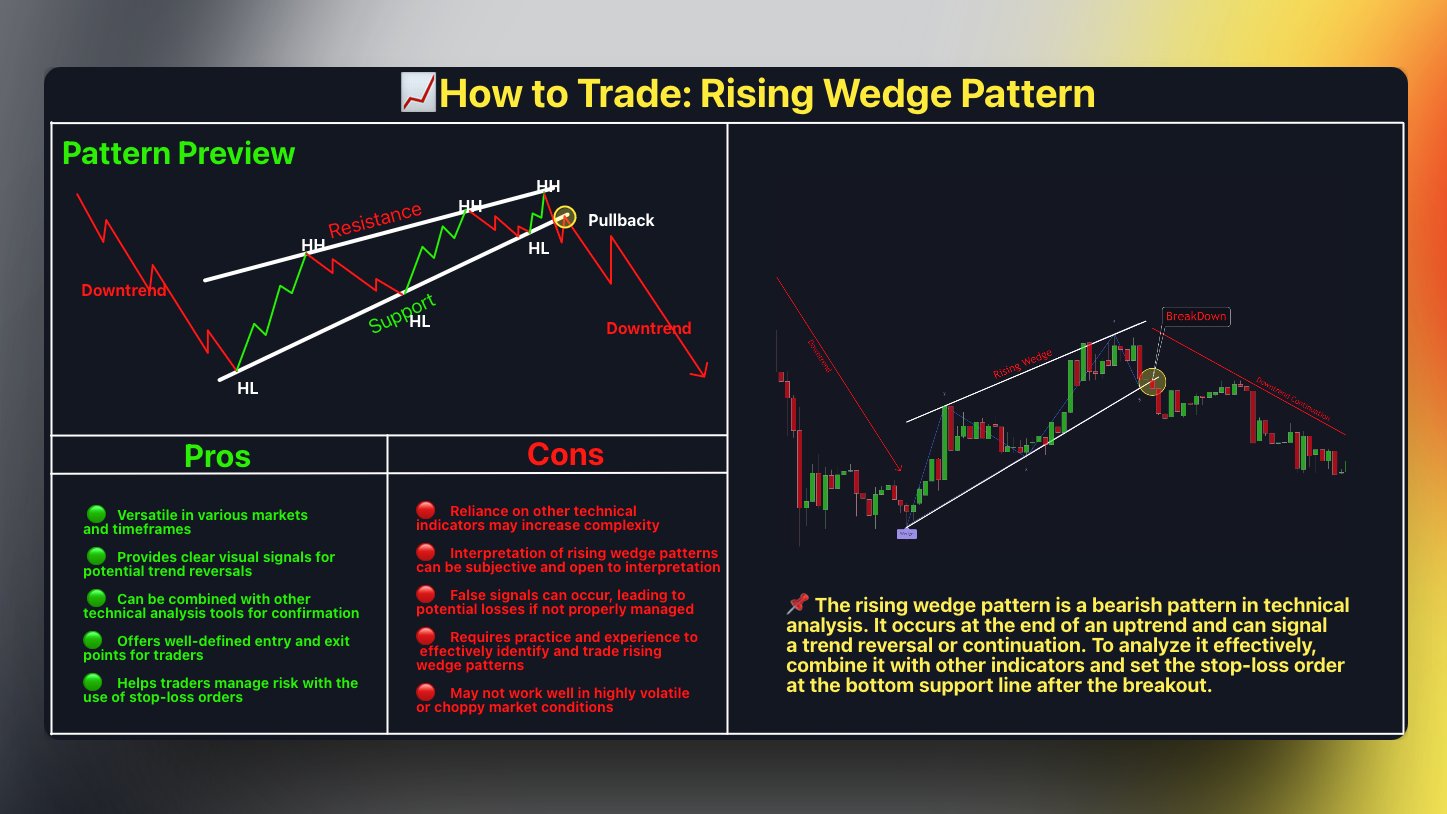

What is the Rising Wedge Pattern?

The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets.

It suggests a potential reversal in the trend. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend.

Traders recognize the rising wedge as a consolidation phase after a medium to long-term trend, indicating a decrease in momentum.

Traders often use this pattern as a signal to take a short-selling position or exit their current position.

How to Identify and Use the Rising Wedge

- Identify an existing trend in a currency pair.

- Draw support and resistance trend lines along with the highs and lows of the trend.

- Wait for price consolidation and the contraction of the support and resistance lines, forming a rising wedge pattern.

- Observe the upper trend line acting as resistance and the lower trend line acting as support, converging

towards each other.

- Place a sell order once the price breaks below the support line of the rising wedge pattern.

- Set a stop-loss order at the same level as the support trend line to manage risk in case the price reverses.

- Consider setting a profit target based on the distance between the highest and lowest points of the wedge pattern or by using a technical indicator or a previous support level as a reference.

Key Takeaways

- The rising wedge is a technical chart pattern used to identify possible trend reversals.

- The pattern appears as an upward-sloping price chart featuring two converging trendlines.

- It is usually accompanied by decreasing trading volume.

- A rising wedge is often considered a bearish chart pattern that indicates a potential breakout to the

downside.

- Wedges can either form in the rising or falling direction.